How the DC pension plan works

The CBPP is a Defined Contribution (DC) pension plan. This means the contributions are fixed, and the benefits at retirement will vary based on the performance of your investments and your account balance at retirement.

Your contributions and your employer’s contributions are both immediately vested, meaning they belong to you right from the start.

Saving with the CBPP is one of the best investments you can make in your future.

Basic contributions & Employer matching

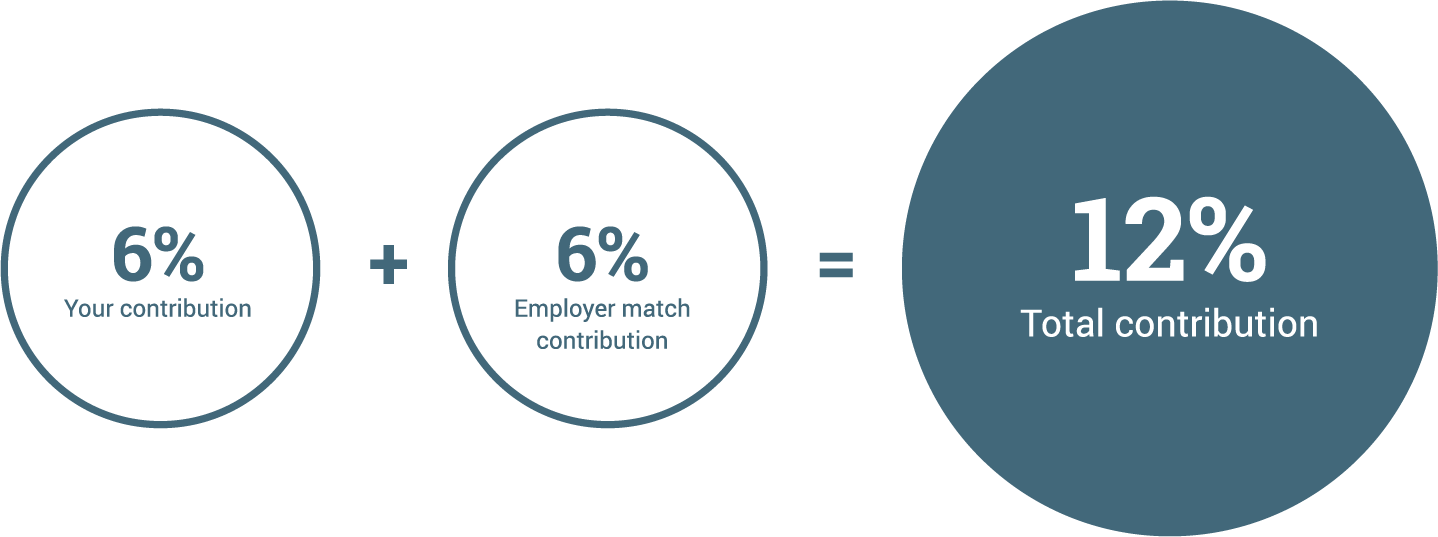

Your basic contribution to the CBPP is 6% of your earnings, made through convenient payroll deductions.

When you contribute 6%, your employer will match those contributions at 100%, which automatically doubles your investment.

Additional voluntary contributions – You can also make additional voluntary contributions, by payroll deduction, in any amount you choose. Just be aware of contribution limits.

Transfers from another plan – With the CBPP you’re able to transfer pension money from a previous employer or an RRSP into your CBPP account, if the other employer’s plan allows this.

Investing is easy with Target Date funds

- You don’t need to choose funds. When you enroll, you will be automatically invested in the Target Date fund that is closest to your retirement year. If you want to change it at any time, you can.

- Designed with your retirement year in mind, the fund gradually shifts your investments to become more conservative over time.

- Offers a hands-off approach. Professionals manage and regularly adjust the mix of investments.

In your early saving years, the fund is invested in more equities to help maximize growth. Then, as you get closer to retirement, the fund gradually becomes more conservative with more fixed-income investments.

Very low fees

Because of the buying power of the CBPP, the fund management fees you pay for your investments are only approximately 0.48%. This is much less than the typical retail fees of 2.00% to 2.50%. This means more of your money stays in your pension account.

Instant tax break

Since your contributions are invested on a before-tax basis, less of your income is taxed. This means that you experience instant tax savings.

Tax-sheltering

All registered plan investment earnings (for example, pension plans and Registered Retirement Savings Plans) grow tax-deferred until you withdraw them (ideally in retirement, when you are in a lower tax bracket).

Withdrawals from the plan

Your basic contributions must stay in the plan while you are employed.

However, additional voluntary contributions can be withdrawn if desired.

Also see withdrawals at retirement: getting ready to retire.

For more detailed information on your DC pension plan, refer to your provincial plan member booklet at Forms & Resources.